What we in marketing call “personalization” isn’t always personal. Products and services may be suggested based on a customer’s past—and personal—purchasing. And that can and certainly does lead to another purchase—or what we call a “conversion.”

Conversions, however, are not personal. Conversations are. Conversions transact; conversations connect.

Yet in the grand scheme of financial services, where customers number in the thousands to the millions, personal hardly seems possible. Several financial services firms and consultancies tackled the problem at Money20/20 2019.

Simulating the Personal Experience

“All the digitization in the world won’t succeed unless it feels like there’s a human there,” said Dion Lisle, managing director at Facere25, a consultancy that builds FinTech solutions. “Digitization yes, but I want it to feel human, like a friend is helping.”

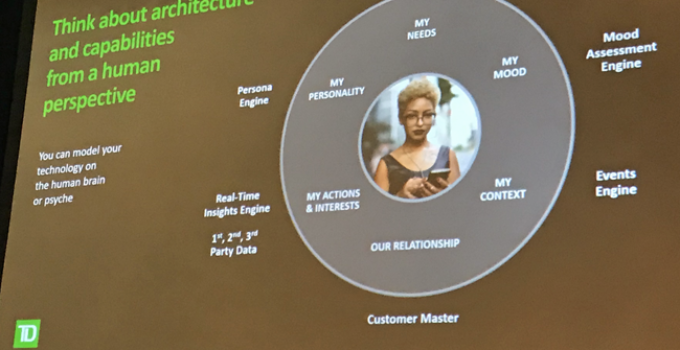

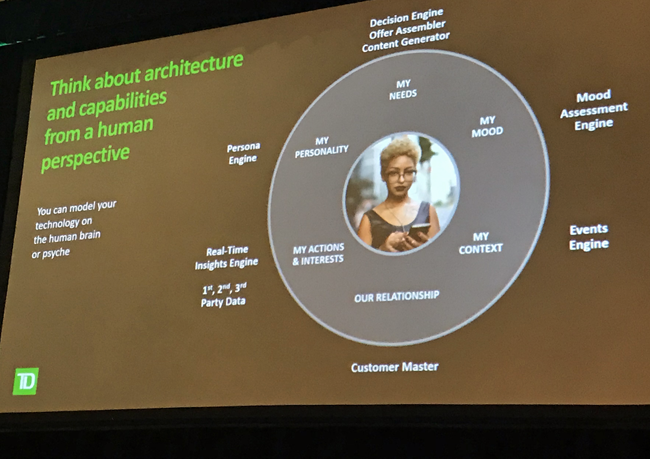

John Thomas, head of global innovation at TD Bank, built his presentation around how to treat customers people rather than conversion metrics. Today’s technology can help bring about personal connections with real people, even if you never meet them in person.

Sometimes it requires you to forget that prospects are marketing personas on a customer journey– technology can tell you about them as people.

“We are letting machine learning tell us what it sees about the customer rather than telling the machine what our business or shareholder objectives are and having it solve for that,” Thomas said. “When we did that, we found it introduced too much bias into the process. . . . The technology can tell you exactly what the persona of a human being is—you don’t have to map it according to your expectations.”

At the same time, not everything has to be “AIed,” as Thomas put it. “You can make massive leaps using traditional algorithmic approaches. . . . But don’t lose sight of the concepts of perception and experience as the goals for customer engagement.”

Making the Customer Experience Easier

The idea, after all, is to remove friction from all customer experiences, no matter what device or channel they use.

“Friction erodes trust. Only one bad experience is all it takes to lose a customer. Potentially forever,” said Kellie Judge, industry manager-financial services at Facebook.

Reducing friction in product design is helping as well.

“As the user experience improves on digital wallets, consumers use them and make payment (card) choices just like they do with leather wallets,” said Marie-Claude Nadeau, co-leader of the North American payments practice at McKinsey & Co.

Creating that kind of experience is one place where FinTech and other technology firms have a lot to offer to banks.

“The beauty of bank and FinTech partnerships is better and more inclusive design,” said David Reiling, CEO at Sunrise Banks in Saint Paul, Minn. (More on Reiling’s presentation in a future article.)

Anticipating Customer Needs

The biggest problem is that often you cannot ask the customer what they want or why they make the choices they make. It’s a basic tenant of behavior science: People do not know why they do what they do, as Kirsten Berman , co-founder of Irrational Labs and Common Cents Labs explained.

Berman’s research shows that companies with the highest percentages of employees who save for retirement do so because they are automatically enrolled in savings plans by default. None of the many more rational reasons employees give about their care for the future holds up. “If we want to build financial solutions that work, we have to build them on actual behavior, not what people say,” she said.

Another technique is thinking about the future in terms of longer-term social trends and applying them to the products and services you design for consumers and businesses. The Hitachi Design Lab created a deck of “foresight cards” that reflect themes in modern life.

Those themes can inform trends that influence product development. The idea is to focus products as much on long-term needs as on current problems and gaps.

“Most people overestimate where they will be in three years,” said Patricia Kroondijke, FinTech strategy manager for Hitachi America. “But most people also underestimate where they will be in 10 years.”