FINTECH ARTICLES OF THE WEEK 02/26/16

These are the two immutable components of business and banking: cashflow and regulation. Both are coming to focus for FinTech firms. Plus the Blockchain Watch in this week’s links.

Cash flow is still king – SMEs get the keys to the ‘Treasury’ chest

FinTech companies are beginning to connect across accounting platforms, removing the need to sync as much of their operations with banks’ existing systems and providing cash flow forecasting tools. According to Daily FinTech, Skippr, Float, and Vistr are among the companies trying their hand at this strategy.

Top 10 trends in banking innovation

Chris Skinner points to banks taking advantage of their data analytics, collecting consumer product input from customers and 24/7 availability as a few of the trends emerging from EFMA research.

To prosper, banks need to move from products to customer financial wellness

The precious financial data that banks collect can provide third parties with valuable consumer spending insight for companies like Amazon or Google. In an interview with

Forbes, FinTech advisor Pascal Bouvier notes solutions for banks to take advantage of their customer data to service them better.

The American bank market’s size challenges faster payments

In order for the America’s payment system to speed up, banks will have to find a better way to collaborate, Payments Source asserts. Doing so will require a lot of time and coordination to implement in order to reach similar ubiquity as that in the United Kingdom.

RegTech to help firms to automate compliance tasks

As the digitization of financial services moves forward, the FinTech label is not specific enough for firms working in its component parts. “RegTech,” technology designed to automate compliance operations and manage risk, is becoming a distinct sector, along with InsureTech. Cities like Dublin, Singapore, New York and Sydney will soon become global centers for the RegTech sector, FinTech News reports.

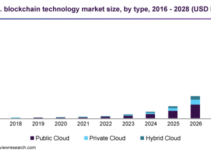

When it comes to blockchain, intellectual property could become more significant as top technologies challenge existing banking systems, but banks, exchanges and payment processing companies may be better off in establishing blockchain rules, Bloomberg reports. That means standards. “The business case for blockchain adoption is still elusive; we always hear about the investments but at this point, no focus is on revenue,” wrote Andrew Deichler, editorial manager for the Association of Financial Professionals, in a series of live tweets from panelists at the Payments Innovation Alliance meeting in San Francisco. Meanwhile, the Wall Street Journal (paywall) reported that JPMorgan quietly test blockchain technology with 2,200 clients on U.S. dollar transfers between the U.K. and Japan in an effort compete with FinTech rivals.

To subscribe to FinTech Rising Articles of the Week, go here.