It doesn’t take special insight to note that 2020 was a tumultuous year for banks—along with the rest of the world—with the dramatic shift to digital and a heavy blow to projections across the board forcing financial institutions to reassess every aspect of how they do business.

Now, looking forward to 2021, the banks are beginning to see challenges the new year will bring—and the best ways to capitalize on the innovations they so quickly adopted over the past year. On top of that, lie innovations younger customers desire that most banks have yet to plan for.

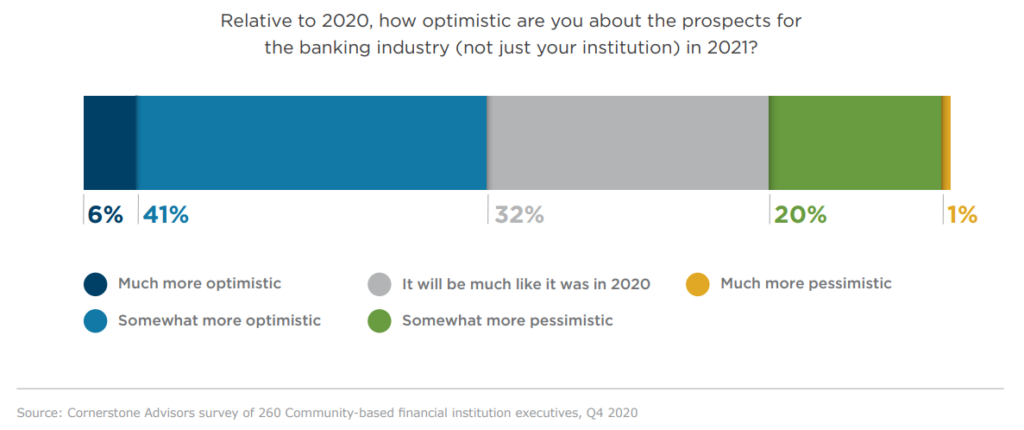

What’s Going On in Banking 2021, a recent study from Cornerstone Advisors, surveyed financial professionals on what trends they see going forward into the new year, and invited experts to comment on what they see as the biggest focus for the next 12 months.

“Our whole strategy begins with our vision: we’ve been here 120 years, how does a bank survive for another 120 years?” said Jill Castilla, President and CEO of Citizens Bank of Edmond. “How do you ensure you can scale, and that it’s sustainable for the long term? 2021 is for us about optimizing efficiency.”

It’s a cautious sort of optimism—with full awareness of the challenges ahead—that set the tone broadly among banks for the new year. 47% of respondents reported they were either much more or somewhat more optimistic about prospects for the industry in 2021 as compared to last year.

“We’re very optimistic about the future, but I think that comes because we’re pessimistic about certain things and have modeled for those things,” said Brett Martinez, President and CEO at Redwood Credit Union. “I’m actually more concerned about 2022-23 in terms of the margins. The focus this year is on growing loans through this period of time and helping every single member. People want a recovery, and when you use the tools to help with that they will.”

As they bring those tools to bear, they’re also very aware of the challenges in this market. The yield curve projections for 2021 remain poor, driven by low interest rates, and that concern leads among issues bankers are flagging.

The prevailing sense for what the biggest competitive threats are moving forward have also been transformed by the last year. Big Tech remains the leading concern for most bankers, but that concern has actually shrunk considerably compared to 2020—the new fastest-growing issue on the block for traditional FIs comes from challenger banks.

And that concern is born out in real data; back in January 2020, only 5% of consumers considered a challenger bank their primary institution according to Cornerstone research. In mid-December, they asked again, and that percentage tripled to 15%—growth that actually puts them ahead of credit unions and other community banks.

“Non-interest income gets obliterated by these challenger banks, everything’s free—no interest, no overdraft fees, etcetera,” Castilla said. “For us, we have to look into what we can do that we know well; things we can license out to other banks. It’s going to bust the normal earning power of a bank, I think. The non-interest income is the big disruption we’re going to see in very short order, and we have to figure out other ways to make money.”

That pressure also represents a need to transform how banks view their relationships with FinTech partners. The old model of benign neglect, where a few IT professionals within the bank were tasked with building partnerships that may or may not have included any functional use cases, are likely nearing their end.

“I think we’re getting to a point where boards are going to start demanding more economic impact from these partnerships,” said Ron Shevlin, Director of Research at Cornerstone Advisors. “A lot of boards describe the FinTech petting zoo, where the only point of the partnerships is to be trotted out before the board.”

That may require some fundamental shifts in thinking for financial institutions—and into services that have not in the past been associated with banks at all.

“Cryptocurrency investing, subscription management, data breach protection—very few respondents noted any interest in these areas,” Shevlin said. “But our consumer research suggests that especially younger people want those services and would be willing to pay for them.”