During a typically busy Money20/20 day of running from one meeting to another, I had a chance to listen to several presentations concerning customer experience and how to use technology and data to make it great. Both are significant challenges to all businesses, but especially financial institutions of all sizes.

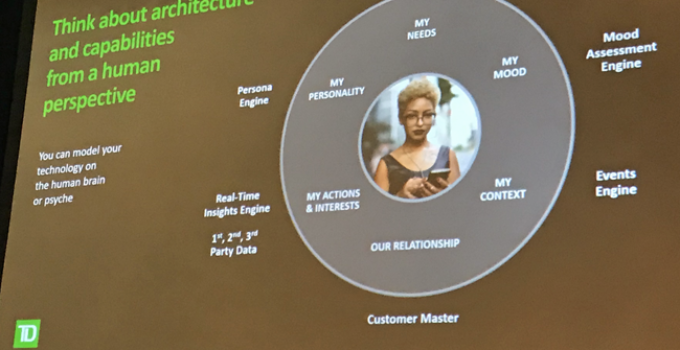

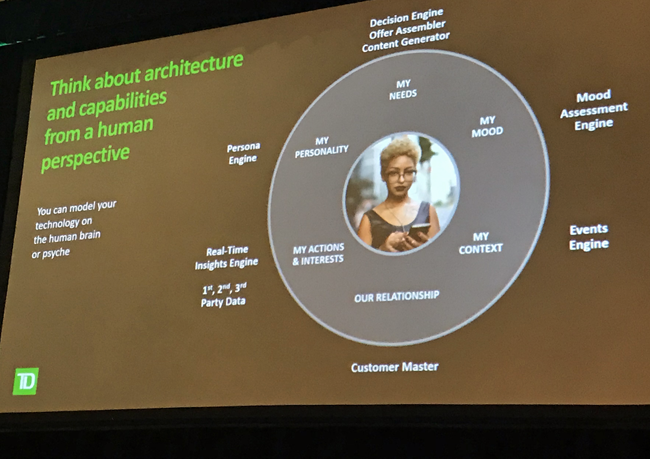

The experience of financial services customers and how to treat them as people rather than conversion metrics formed the basis of a presentation by John Thomas, head of global innovation at TD Bank. If used with that in mind, today’s technology can help bring about personal connections with real people, even if you never meet them in person.

“We are letting machine learning tell us what it sees about the customer rather than telling the machine what our business or shareholder objectives are and having it solve for that. When we did that, we found it introduced too much bias into the process. . . . The technology can tell you exactly what the persona of a human being is—you don’t have to map it according to your expectations.”

At the same time, not everything has to be “AIed,” as he put it. “You can make massive leaps using traditional algorithmic approaches. . . . But don’t lose sight of the concepts of perception and experience as the goals for customer engagement.

The idea, after all, is to remove friction from all customer experiences, no matter what device or channel they use. “Friction erodes trust. Only one bad experience is all it takes to lose a customer. Potentially forever,” said Kellie Judge, industry manager-financial services, at Facebook.

Creating that kind of experience is one place where FinTech and other technology firms have a lot to offer to banks. “The beauty of bank and FinTech partnerships is better and more inclusive design,” said David Reiling, CEO at Sunrise Banks, Saint Paul, Minn.

Community partnerships are also important. Reiling told the story of how he started the bank by focusing on an immigrant community in Saint Paul. “If the community succeeded, the bank would succeed,” he said. Both have.

I also had a conversation with Ankur Mehrotra, managing director of financial services at Grab. Grab started as a Singapore-based ride hailing service, started to offer food delivery, moved into payments, and last year announced its entry into lending and insurance.

If the playbook sounds familiar, it may be because Grab bought Uber’s business in Singapore, after heated competition, and its CEO, Dara Khosrowshahi, sits on the Grab board.

Grab also focused on community ecosystems and built up data on consumer and merchant transactions unavailable—the vast majority of consumers and merchants in South East Asia do not have banking and credit histories. The success of its financial services offerings rest on “having an ecosystem and data that nobody else has.”