The global pandemic, beyond the crisis it represents for public health, has had a drastic effect on business sectors around the world throughout 2020. And while news that many business goals have been negatively affected for the financial services industry – along with many others – a survey conducted jointly by the UK-based Financial Services Club and US-based Ravco Marketing has found that not all areas have been impacted in predictable ways.

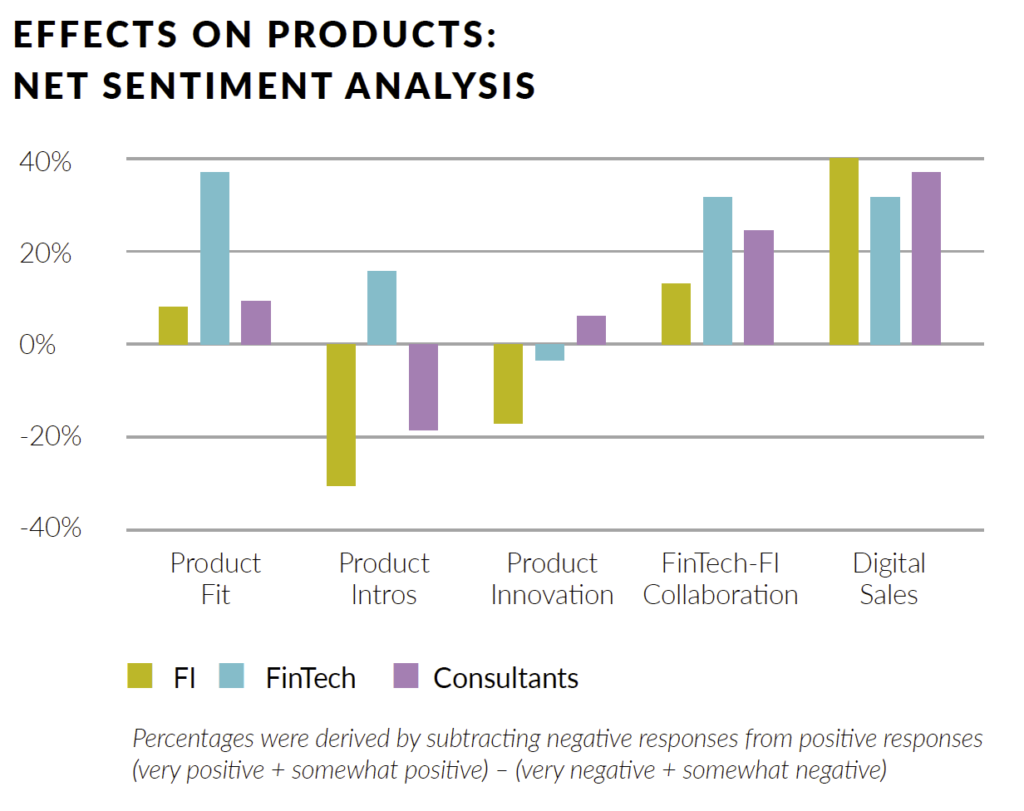

Around 43% of financial institution respondents reported a surprising notion that the crisis has had a positive impact on their product fit for the market – and even more, at 60%, among FinTech respondents noted the same.

Work from home has also been broadly seen as a success, with 82% suggesting they will seek to continue similar programs even after the pandemic has abated – and 81% of FIs seeing this area in particular significant enough that it will likely reduce future office space needs, possibly signaling a long-term shift to work from home as a norm in the space.

Almost half of respondents further noted that customer loyalty remains strong, predicting that only a small number of customers would switch accounts. An even broader segment, 57%, noted a feeling that customer relationships have actually been improved during the pandemic.

The news isn’t all positive, of course. While some respondents did suggest that certain sectors of their work – IT and technology, in particular – may have actually been positively impacted, some 62% of all respondents noted that sales have suffered, and that business goals for the year both in sales and marketing will likely not be possible to meet in many organizations.

Globally, most industry professionals surveyed noted feeling well-prepared for a crisis. Yet nearly 40% of Americans surveyed said they were unprepared to process the government programs that were funneled through their organization – an unsurprising statistic, given the well-documented issues many traditional banks had in dealing with the Payroll Protection Program in particular.

Above all, the most pervasive feeling seems to be that longer-term change is in the air as a result of the shifts that have been made. Some 56% of respondents thought that there would be “many changes” to the financial services industry as a result of the crisis, with an additional 27% predicting “dramatic” changes.

“The industry has talked about digital transformation for over a decade and many are now realizing the need to accelerate their investment to become a truly digital bank and better able to compete with the growing number of challenger banks that are well-positioned for a post-pandemic world,” said Chris Skinner, chairman of the Financial Services Club.

Download the full report from the Ravco Marketing website.