As bitcoin prices have exploded upward throughout the beginning of this year, many traditional financial institutions have been forced to one conclusion: cryptocurrency is here to stay. Even if your institution doesn’t plan to deal directly in the space, the need to be knowledgeable about it is becoming an increasing imperative.

But it’s a complicated subject – a crowded market, with murky and probably insufficient regulations and a lot of still-evolving technologies powering it. Panelists at a recent meeting held by the Barack Ferrazzano Financial Institutions Group discussed some of the most important things for financial professionals to know.

“If you look at the whole landscape, there’s over 4,000 currencies out there,” said Peter Stern, head of business development & partnerships at CF Benchmarks, a firm that provides cryptocurrency asset indices. “There are also hundreds of exchanges they trade on, domiciled all over the country. That makes KYC/AML hard. And it’s hard to value it; cryptos don’t pay a dividend, and they don’t have a yield. If you don’t understand, you’re not behind – a number of the global institutions I speak to still don’t understand it at all.”

Despite this abundance of coins, most aren’t actually particularly important to understand – coins are launched every day, and many of them are extremely low in legitimacy. For financial institutions, it’s really first and foremost about understanding Bitcoin.

“We’re talking about what a regulated entity should be thinking about,” said Jay Schulman, National Leader in Blockchain and Digital Assets at RSM, an audit and tax-focused consultancy. “That’s the difference from the news of the day – Coinbase isn’t a bank, not a traditionally regulated entity. There are a set of cryptos that are commodities – that is bitcoin, that is Ethereum, and some of their derivatives. That’s it.”

And sticking to this short list of commodity cryptocurrencies is important, at least in the short term – most of the many coins out there are not defined at all in any regulatory sense – and that’s dangerous ground for banks in particular, as it adds an extra layer of risk above and beyond the already-volatile crypto markets.

Even with this more limited field, the mechanics of trading in these assets still takes some finesse. There is currently no ETF for Bitcoin in the United States, and while efforts continue to change that fact, in the meantime, trading in crypto represents a much stronger security risk for institutions, who generally need to take on custody of the assets themselves.

“If you offer those products, it needs to go through a professional security and operational setup to protect your clients as well as yourself,” Stern said. “If clients are managing it themselves, they’re subjecting themselves to risk – if you lose your phone, people can SIM hack it to gain access to your accounts. And once money is stolen from a crypto wallet, it’s gone; essentially impossible to recover.”

That security is more complex than it is for most commodities, in addition; the list of things to track enters into spaces many traditional parts of the sector are not accustomed to having to deal with.

“When you enter into crypto, the KYC component is incredibly important, but there’s an added thing – KYT – know your transaction – which the regulators are incredibly focused on,” Stern said. “Ultimately, it’s not enough to just know where the customer came from, but where that money came from. You need to know the history of that bitcoin much more.”

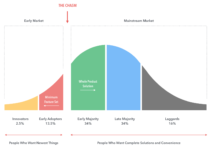

Despite the volatility and inherent security risks, crypto also represents a strong opportunity for disruption for savvy financial institutions that place themselves ahead of the curve.

“Think about where you were 15 years ago in the evolution of digital banking,” Schulman said. “This is the next evolution of what a bank is going to look like. I go back to FINRA guidance from 2015 that stated that a good control location for crypto is with a bank. I think this is why the OCC is issuing banking charters to some crypto firms – they feel a lot more like a trust bank. It’s about the custody of these funds. There’s a lot of security implications of working in this space, so having a bank handle that is really advantageous.

“Just like with internet banks way back when certainly these crypto banks are coming up. I think they will be very successful in the short run because the products and services haven’t rippled through the rest of the sector yet. But in five years, a crypto bank will look like an internet bank does today; it all just blends together as one of the products that we have.”