Addendum: This quote from 04/21/21 NY Times DealBook supports the general trend:

“The public listing of Coinbase, the largest crypto exchange in the U.S., generated a wave of excitement that competitors aim to ride. Among them is Binance.US, the third-ranked domestic crypto exchange, which yesterday named Brian Brooks — formerly Coinbase’s chief counsel and most recently acting U.S. comptroller of the currency — as C.E.O., beginning in May.”

One of the most famous scenes in one of the best movies ever made, All the President’s Men, shows a close-up of the late Hal Holbrook telling a journalist how to unravel the puzzle of the burglary at the Watergate Hotel. Hidden in the dark shadows of a deserted parking garage in the middle of the night, Holbrook, playing the secret source Deep Throat, intensely whispers, “Follow the money.” It startles Robert Redford, playing Washington Post reporter Bob Woodward.

The trail of money into cryptocurrency and FinTech is no less startling.

Cryptocurrency exchange Coinbase went public this week, a first for a major cryptofinance company. It’s the latest in a series of fundings and product announcements that show the financial magnitude of the technological shift in finance.

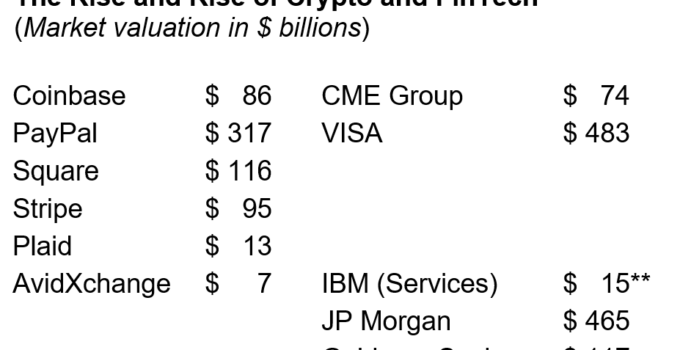

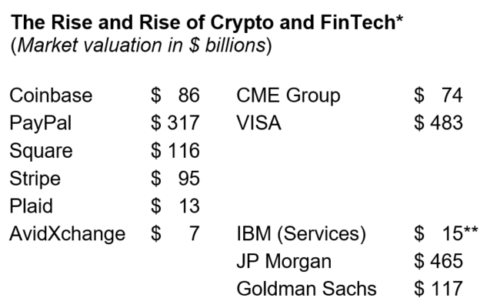

This chart shows crypto and FinTech firms that have been in the news recently. They raised financing, either through private investments or through an exchange listing. They have new cryptofinance products; they were lauded for their acceptance of bitcoin; or their executives commented on the emerging FinTech ecosystem.

The comparisons to traditional finance companies are striking in terms of how much markets are valuing the new firms, rooted in networked computing, compared to the much older companies built on physical collateral and electronic money transfer. And yes, these comparisons are not accurate or fair and may have nothing to do with results generated from current or even future sales revenue, which is the ultimate determinate of business value in my book.

Yet they are indicative of how investors continue to perceive the shift to internet-based, digital finance from payments firms to crypto exchanges. Compare it to Google’s “wild bet” when it bought YouTube for $1.65 billion in 2006, and consider how streaming services like Netflix now compare to and have changed the services of network television and movie makers, especially over the pandemic.

These valuations and the customer and technology changes behind them are not lost on traditional finance companies. “Banks have enormous competitive threats — from virtually every angle. Fintech and Big Tech are here… big time!,” wrote JP Morgan CEO Jaime Dimon in his annual letter to shareholders.

At the Texas A&M Bitcoin Conference 2021 this week, hedge-fund icon Ray Dailo went bullish on bitcoin and made a case for investing in it to diversify portfolios. “Bitcoin has proven itself… as money with imputed value,” he said.

That’s where cryptofinance is today and why The New York Times calls the Coinbase listing a “landmark moment for crypto.” And the rapidly increasing values are why Forbes digital assets writer Steven Ehrlich concludes, “This is not the end of the story, as much work remains to be done as the industry continues to fight for legitimacy and investors try to figure out what bucket to place Coinbase into.” (paid link)

They will. Although bitcoin may have been conceived a decade ago as an antidote to the excesses and unfairness of the traditional financial system, the innovations that led to crypto and FinTech firms grew from innovations in traditional finance. John Lothian News tell that story in “The Path to Electronic Trading Led to a Best Execution Platform for Bitcoin.”

* The movie “The Rise and Rise of Bitcoin” was my initial introduction to crypto in 2014. We screened it as our first public FinTech event in Chicago.

** This figure is a rough estimate of IBM’s 2020 revenue contributed by IBM Global Business Services, based on its Q4 contribution of some 20%, which covers a wide range of corporate automation services. AvidExchange is a B2B FinTech that automates accounts payable and is expected to go public.