A post crossed my LinkedIn feed last week stating the blockchain technology had “crossed the chasm” in enterprise finance, taking as evidence that awareness among large financial institutions is high, especially with JP Morgan’s recent cryptocurrency- and blockchain technology-based service announcements.

To check my initial reaction, I went back to my dog-eared and highlighted copy of Geoffrey A. Moore’s classic and essential book, Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers. As I suspected, the short of it is blockchain and cryptocurrency technologies are far from crossing the chasm.

Don’t get me wrong. There has been a lot of progress over the last year. Several finance-related blockchain projects are progressing nicely, becoming increasingly real products. On the trading side, trading technology firms are releasing products for professional traders aimed at the institutional investment market.

But awareness and products, alone or together, do not “chasm crossing” make.

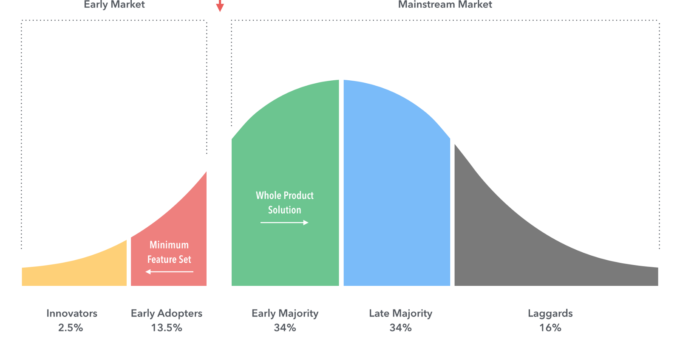

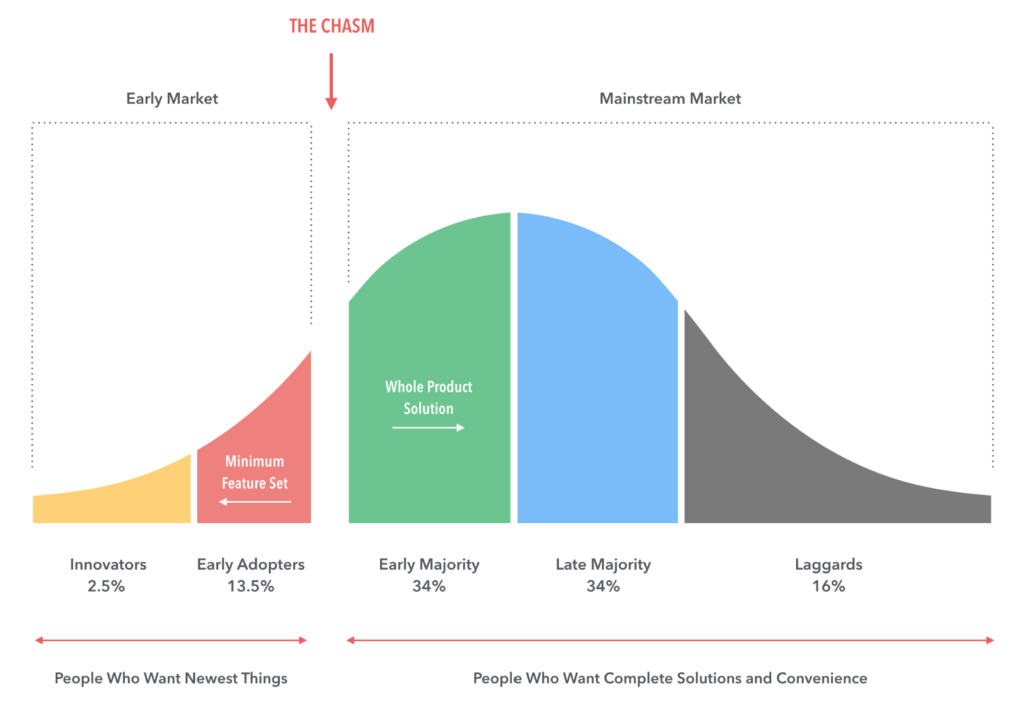

It takes real, paying customers to cross the chasm. It takes moving through the “innovators” and “early adaptors” stages of the technology adoption life cycle to even get to the chasm. I’m quite certain that blockchain and cryptocurrency projects are firmly in proof-of-concept and early-product states, the province of the technically proficient innovators and visionary early adopters that Moore describes.

Source: Shah Mohammed, Design for “Crossing the Chasm”

At that point lies the chasm to be crossed, to the early majority, the land of the pragmatists. As Moore writes:

Throughout the 1980s, the early majority, or pragmatists, have represented the bulk of the market volume for any technology product. You can succeed with the visionaries, and you can thereby get a reputation for being a high flyer with a hot product, but that is not ultimately where the dollars are.

Pragmatists are the people who tend to manage enterprise IT departments, who control the budgets that any technology startup dearly wants to get its hands on. It’s the land of “incremental, measurable, predictable progress,” in Moore’s words. Not exactly the language of crypto-land.

If you think of the chasm in Moore’s terms, you aren’t there until your proven product can firmly be justified by the 34% of the market that lies after the first 16% of market innovators that are excited enough to give it a try. (See Everett Rogers’s Diffusion of Innovations theory for details on how Moore splits the bell curve.)

Getting to the chasm for enterprise finance blockchain means that 16% of enterprise financial institution customers buy a cryptocurrency or blockchain-technology product, not even that 16% of enterprise financial institutions develop and market one. That brings you to the chasm, the starting point of mass-market acceptance. I would guess that even the largest blockchain technology project, bitcoin, is not even close to being used by 16% of potential consumers, regardless of how you choose to count them.

Nobody said developing, marketing, and selling new technology is quick or easy, least of all Moore. If you haven’t read his book, I strongly urge that you do. Book cover lines often are hyped-up logrolling. In this case, “The bible for entrepreneurial marketing” gets it exactly right.