Payments Innovation 2017

John Chaplin, Chairman, Global Payments Innovation Jury

Payments continues to experience unrelenting innovation worldwide, with established players trying to defend and grow their existing business and new market entrants aiming to grab a share of the market for themselves. While operating margins are under pressure, the payments sector remains attractive because the market continues to expand and there is opportunity to secure a share of gross transaction value for many players.

The Global Payments Innovation Jury was set up to provide a consistent view of this evolution every two years and the 2017 Jury, comprising 70 successful payments executives from 37 countries, has recently released its latest report which considers many aspects of the worldwide industry and gives its considered views on how innovation is occurring and bringing about change.

Innovation in payments has increased in pace since the Jury was last convened. Across the world, there is a higher level of focus on innovation, driven by a combination of startups entering the market and established businesses digitising as fast as possible. Yet, while innovation is steadily increasing across the globe, the direction it takes varies significantly from region to region.

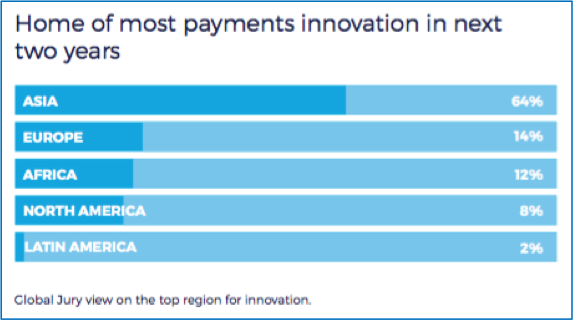

By a very substantial margin, the Jury rated Asia as the home to most payments innovation over the next two years, a position that it has held since the inaugural 2008 Jury. However, the 2017 Jury saw the innovation leadership position of Asia as being stronger and more entrenched than previous juries.

Europe took the second spot this year, leapfrogging Africa, North America and Latin America which took third, fourth and fifth positions respectively.

Since 2008 Europe has been at the bottom of the table for innovation potential so this is a notable change. Africa, third this time compared to second in 2015, scored strongly and again ranked above the USA. Given that there are funding issues for fintech and payments companies in Africa, this result was striking. The USA, if measured on dollars invested and press coverage of innovation, arguably should be the equal of Asia, but lagged well behind and many jurors commented that ageing infrastructure is holding the country back.

“USA is way behind on payment innovation because reluctant incumbents on both the merchant and banking side have favoured legacy over new tech.”

So why is Asia thriving? The fintech boom in Asia is well documented and continues to go from strength to strength. China is clearly intent on being the global fintech leader; India is acting as the other regional power house, with an aggressive payments modernisation and innovation agenda driven by the NPCI. Smaller markets such as Hong Kong, Malaysia and Singapore are rapidly modernising their payments infrastructures and are also aiming to be significant players in fintech, with Singapore showing the way.

The opportunities in the region are widespread due to the rapid population growth, high willingness to accept new technology and the sheer size of the market opportunity to convert from cash to digital payments in economies where the reach of traditional banks is limited. The value of mobile payments in China alone in 2016 was estimated at $5.5 trillion US$1 – 50 times more than the value of mobile payments made in the USA.

If you would like to read this year’s Global Payments Innovation Jury Report you can the download a free copy here https://innovationjury.com/.

John Chaplin is an adviser to Helios Investment Partners, the major African private equity fund and is a Director of Interswitch in West Africa and Fawry in Egypt. He is the organiser of the Global Payments Innovation Jury, a prestigious group of 70 industry leading CEO’s, that convenes every 2 years to look at the state of innovation in the payments sector.